As time goes on, payment companies are starting to take crypto more seriously. Read our timeline to see what it took to get to this point.

182Gnp14rfFzoiDKkW7mtsYxp3B3UfFYxa

In the early days, it was hard to spend your cryptocurrencies online somewhere other than the dark web, so companies like BitPay and Coinkite have popped up, trying to develop a solution for it.

It was successful, but not yet ready for adoption, as the general public is not comfortable sending cryptocurrencies manually to a long string of characters.

Later on, people have wanted to spend crypto in real life too, so websites like coinmap have started to gain popularity.

Tools like coinmap have gained popularity within the crypto community, as it gave users a way to search for bitcoin-friendly businesses in their area.

These businesses had different ways of accepting cryptocurrencies, some used a dedicated phone with a mobile wallet, some purchased a payment terminal, but none of these solutions have made it into the mainstream.

The few places that have only accepted bitcoin, and were strictly against accepting fiat currencies have almost all died out.

Late 2013 Coinkite payment terminal. The company is mainly working on hardware wallets now.

Adoption

As crypto has matured, major companies like MasterCard and Visa have made it possible to spend crypto anywhere in the world, where debit cards are accepted.

Xapo was the first to deliver a debit card where you didn’t have to sell your cryptocurrencies before making a purchase.

Since then, other companies have started to follow suit and made it possible for users to spend their cryptocurrencies, like Coinbase with its Coinbase Card.

Major Players

Major companies have approached the demand to add cryptocurrencies differently, some have tried to delay it as long as they could, while others were faster.

Cash App

Cash App was one of the first to add Bitcoin, allowing its users to send and receive cryptocurrencies using a simple cashtag.

Jack Dorsey has contributed a lot to the crypto community, not just with his Cash App, but he also advocates for Bitcoin and decentralization in general.

He has founded Square Crypto, which is part of Square Inc., the parent company of Cash App.

Square Crypto was created to give back to the open-source bitcoin community.

Revolut

Revolut is one of the biggest online banks in the world, available in most of Europe, North America, Australia, and some parts of Asia.

They are very open towards cryptocurrencies, and unlike Cash App, they give you the ability to buy and sell major altcoins too.

They have updated their cryptocurrency terms recently.

Revolut is the legal owner of the cryptocurrencies you purchase within their app; however, from the 27th of July, this will change, and you will be the sole owner of it.

This term change could mean that direct cryptocurrency deposits are withdrawals are coming.

PayPal and Venmo

Both Venmo and its parent company PayPal have been against cryptocurrencies, but this could change in the future.

Recently coindesk has reported that they are planning to roll out crypto buying and selling.

The company has also posted job openings for blockchain engineers, earlier this year.

PayPal’s Chief Technology Officer, Sri Shivananda, said the following part in an interview:

“We are a strong believer in the potential of blockchain. The digitization of currency is only a matter of when not if.”

Decentralized Finance

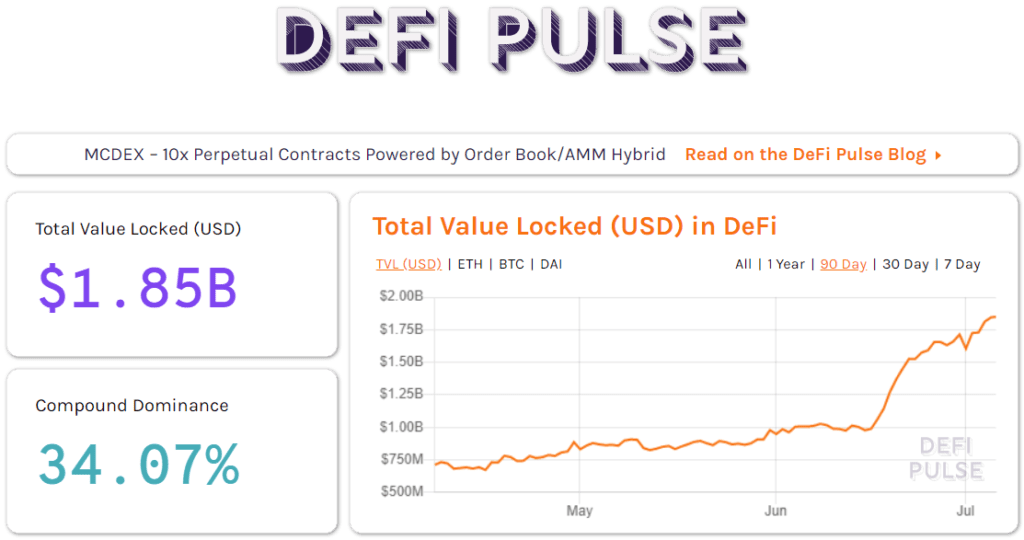

Projects built around DeFi are gaining massive popularity, with millions of dollars pouring into these cryptocurrencies every single day.

This could massively speed up the rate centralized finance companies will have to adopt cryptocurrencies if they don’t want to get left behind.

It is currently unknown if DeFi is just a phase or not, but it certainly brings attention to actual working products, which is a breath of fresh air for the crypto community.

False promises and initial coin offerings that ended in an exit scam have tainted crypto’s reputation, so it’s nice to see teams delivering on what they have planned.

Most of the crypto community agrees that one of the biggest obstacles to mainstream adoption is the fact that the general public is not comfortable to be their own bank, so in the end, for DeFi to survive, these projects will need to be as user friendly as possible.

![NullFUD – Financial Market [Fact Checks / News / Reviews] NullFUD](https://nullfud.com/wp-content/uploads/2019/07/272_90-nullfud-logo-with-text.png)