Even though FTX is one of the newest cryptocurrency exchanges, they’ve managed to gain popularity by offering unique products, such as leveraged tokens.

Breakdown

| US Residents Allowed | Yes, on FTX.US |

| Exchange Type | Centralized |

| Exchange Token | Yes, FTX Token |

| Two-Factor Authentication | Yes |

| Foundation Date | 2019 |

| Headquarters | Antigua and Barbuda |

| Withdrawal Limit Without KYC Documents | 2000 USD Daily |

| Fiat-to-Crypto | Yes |

| Crypto-to-Fiat | Yes |

| Bank Deposits | Yes |

| Bank Withdrawals | Yes |

| Credit/Debit Card Purchases | Yes |

| Trading Fees | Not Fixed | See Fees |

| Margin Trading | Yes |

Start and Founders

FTX started in 2019 by Sam Bankman-Fried (CEO) and Gary Wang (CTO).

They have worked on Alameda Research since 2017, which is a top liquidity provider on multiple exchanges, which made it possible to launch the exchange with volume from day one.

The company behind the exchange is incorporated in Antigua and Barbuda.

Security

You can add two-factor authentication to protect your account — which we highly suggest.

The exchange has an insurance fund to cover losses in case there is a malfunction — please note that this is not used to bail out your losing trades.

The combined total loss could be bigger than the insurance fund can cover, so please do not store your cryptocurrencies on an exchange.

We strongly recommend everyone to use a hardware wallet.

FTX Token

FTX launched its token sale back in 2019 with the ICO price of $0.8, and like many other exchange tokens, came out positive from the bear market while the majority of altcoins have lost most of their value.

The token is used for three things, which are the following:

- Token Burn: One-third of all fees generated by the exchange will be used for an FTT repurchase until at least half of the FTT supply is taken out of existence. The purchased FTT will be sent to a burner address, so the total supply will keep decreasing.

- Discounted Trading Fees: Users that hold FTT will have lower fees on the exchange.

- Collateral: The token can be used as collateral for trading positions.

Unique Products

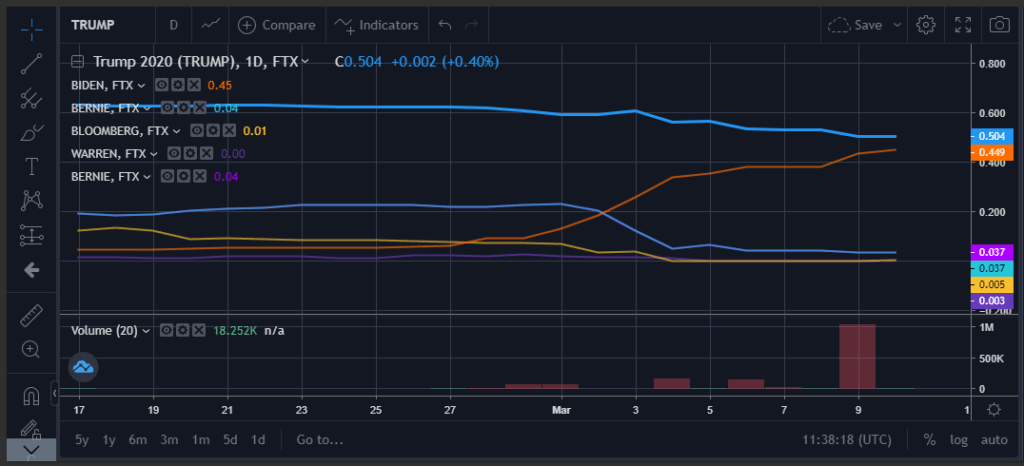

FTX stands out with unique products, such as leveraged tokens, prediction markets, or the quant zone, where you can build and share trading strategies, and earn fees after other traders when they use yours.

Holding leveraged tokens is usually a bad idea for the long-term, as cryptocurrency markets are extremely volatile, and rebalances — to avoid liquidation — can massively reduce the value of the tokens you are holding.

You should use these to increase your leverage if you are sure that the market is going in one direction.

Main Focus

FTX’s main focus is building a platform for professional traders, while also offering products that are unusual in the cryptocurrency space, such as trading gold, or indexes that include multiple cryptocurrencies.

Frequently Asked Questions

Pros and Cons

Pros

- Unique products

- Backed by the top cryptocurrency liquidity provider

- Gives you the ability to margin trade

- Reasonable fees

- Gives you the ability to trade futures contracts

- Has an OTC desk

Cons

- US residents have to use a different site with limited cryptocurrencies

- Not insured

Fees

| Maker | Taker | 30 Day Volume |

| 0.02% | 0.07% | 0 |

| 0.02% | 0.06% | > $1,000,000 |

| 0.015% | 0.055% | > $5,000,000 |

| 0.015% | 0.05% | > $10,000,000 |

| 0.01% | 0.045% | > $15,000,000 |

| 0.01% | 0.04% | ≥ $35,000,000 |

You can also further reduce it by holding FTT; the more you hold, the higher the fee reduction.

Use one of the links in this review to receive 5% off your trading fees.

Review Summary

8.7/10

Overall Score

Disclosure: The links in this review are referral links. Using them costs you nothing, but allows us to pay for hosting, and work on quality, fact-based reporting, which we are really thankful for.

We did not contact anyone before writing this review, and we rated them to our best knowledge.

![NullFUD – Financial Market [Fact Checks / News / Reviews] NullFUD](https://nullfud.com/wp-content/uploads/2019/07/272_90-nullfud-logo-with-text.png)