Bitfinex is one of the oldest cryptocurrency exchanges, and even after 8 years, it’s still the go-to place for a lot of people that trade with a serious amount.

Breakdown

| US Residents Allowed | No |

| Exchange Type | Centralized |

| Exchange Token | Yes, LEO Token |

| Two-Factor Authentication | Yes |

| Foundation Date | 2012 |

| Headquarters | Hong Kong |

| Withdrawal Limit Without KYC Documents | No Limit for Cryptocurrencies |

| Fiat-to-Crypto | Yes |

| Crypto-to-Fiat | Yes |

| Bank Deposits | Yes |

| Bank Withdrawals | Yes |

| Credit/Debit Card Purchases | Yes |

| Trading Fees | Not Fixed | See Fees |

| Margin Trading | Yes |

Start and Founders

Bitfinex started in December 2012, as a peer-to-peer bitcoin exchange, by Giancarlo Devasini and Raphael Nicolle.

The company behind Bitfinex also launched Tether (USDT), the most widespread stablecoin available at the moment. — You can read more about Tether here.

Bitfinex is operated by iFinex Inc., which has a headquarter in Hong Kong.

Security

You can add two-factor authentication to protect your account — which we highly suggest.

The exchange has been hacked multiple times in the past, first in 2015 for $400 000, and then in 2016 for $73 million.

The second hack was so significant that it has also massively crushed bitcoin’s price at the time.

However, to Bitfinex’s defense, they have managed to bounce back on both occasions.

We strongly recommend everyone to use a hardware wallet.

LEO Token

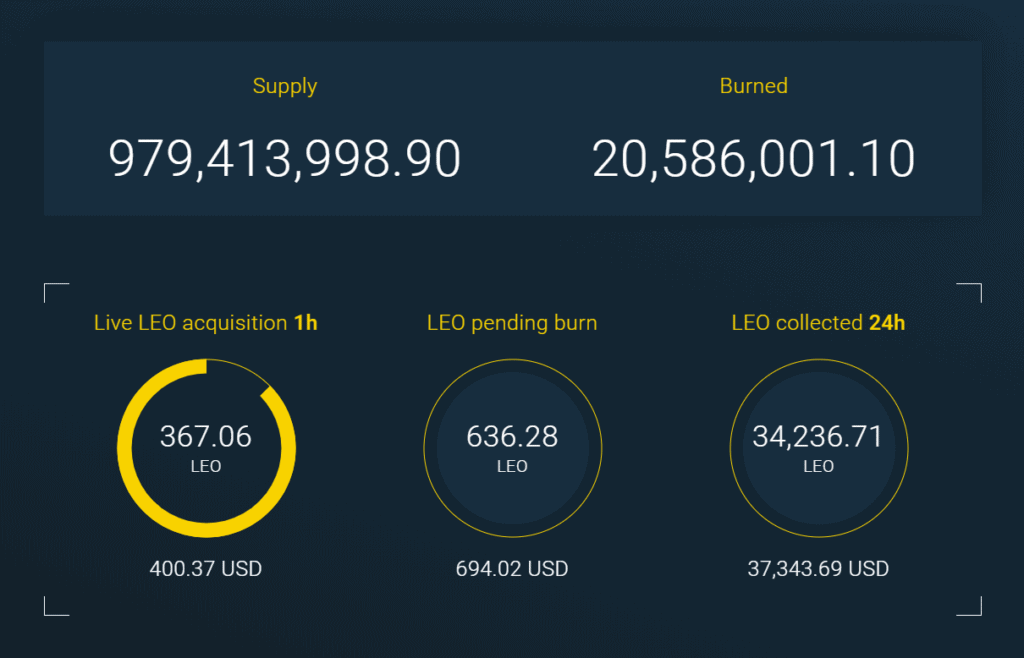

Bitfinex launched their LEO Token in a private sale back in May 2019, so retail investors didn’t have a chance to participate in this Initial Exchange Offering.

The total amount that was raised was $1 billion.

The token is used to reduce fees from 15% to 25% on their platform.

The company is also buying back, and burning tokens based on their revenue, which could drive up the price in the future, as the supply keeps decreasing — please note that this does not guarantee that the demand will keep growing as well.

Main Focus

Bitfinex’s main focus is to create a platform for professional traders, while making it accessible to retail investors too, in the past they used to have a $10 000 minimum equity for using their exchange, but this has been gone for a while now.

Tether

Bitfinex’s parent company is the creator of the most widespread stablecoin, called Tether (USDT).

There used to be a lot of negative press around it, claiming that it’s not fully backed, or that it has been used to create the 2017 bubble.

While Tether has remained the most popular stablecoin, others have emerged, both decentralized ones, such as Reserve Protocol, or Dai, as well as centralized ones, which are mainly made by exchanges, such as USDC by Coinbase, BUSD by Binance, or HUSD by Huobi.

Frequently Asked Questions

Pros and Cons

Pros

- Great liquidity

- Gives you the ability to margin trade

- Reasonable fees

- Has an OTC desk

- Wide variety of cryptocurrencies

- One of the longest-standing exchange

Cons

- Not available to US residents

- Bad Reputation

- Not insured

Fees

| Maker | Taker | 30 Day Volume |

| 0.1% | 0.2% | 0 |

| 0.08% | 0.2% | > $500,000 |

| 0.06% | 0.2% | > $1,000,000 |

| 0.04% | 0.2% | > $2,500,000 |

| 0.02% | 0.2% | > $5,000,000 |

| 0.00% | 0.2% | > $7,500,000 |

You can also further reduce it by holding LEO; by holding at least 1 USDT worth of LEO, you reduce your taker fees by 15%, while if you hold at least 5000 USDT worth of LEO, you can reduce your taker fees by 25%.

Use one of the links in this review to receive 6% off your trading fees.

Review Summary

7.6/10

Overall Score

Disclosure: The links in this review are referral links. Using them costs you nothing, but allows us to pay for hosting, and work on quality, fact-based reporting, which we are really thankful for.

We did not contact anyone before writing this review, and we rated them to our best knowledge.

![NullFUD – Financial Market [Fact Checks / News / Reviews] NullFUD](https://nullfud.com/wp-content/uploads/2019/07/272_90-nullfud-logo-with-text.png)