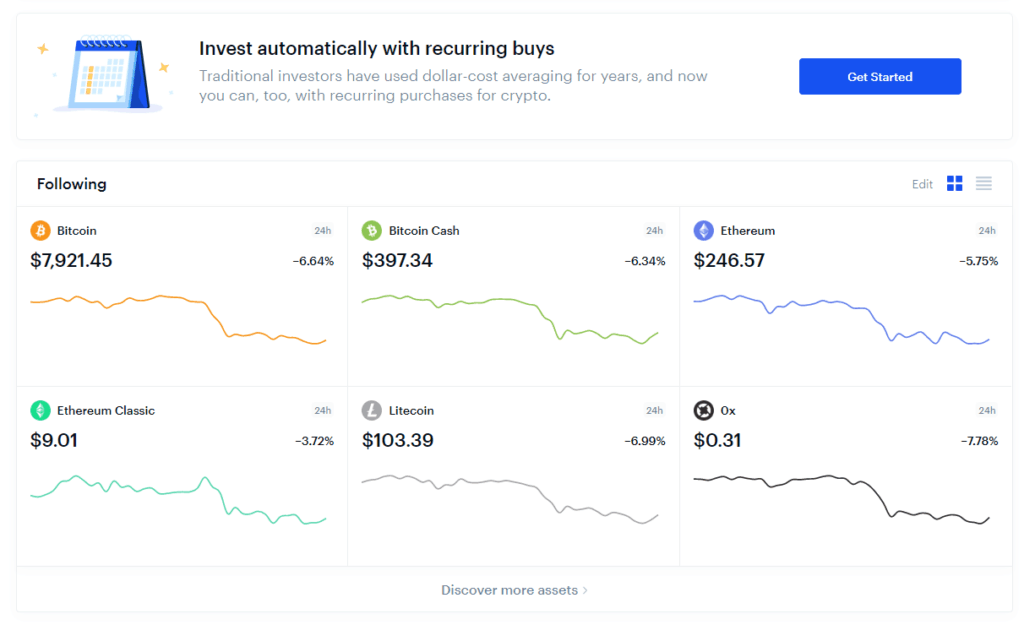

Coinbase is the easiest and most popular exchange to buy and sell cryptocurrencies using fiat currencies, such as the Dollar or the Euro.

Breakdown

| US Residents Allowed | Yes |

| Exchange Type | Centralized |

| Exchange Token | No |

| Two-Factor Authentication | Yes |

| Foundation Date | 2012 |

| Headquarters | San Francisco, California, U.S. |

| Withdrawal Limit Without KYC Documents | KYC is Needed |

| Fiat-to-Crypto | Yes |

| Crypto-to-Fiat | Yes |

| Bank Deposits | Yes |

| Bank Withdrawals | Yes |

| Credit/Debit Card Purchases | Yes |

| Trading Fees | Not Fixed | See Fees |

| Margin Trading | Yes on Coinbase Pro |

Start and Founders

Coinbase started in June 2012, by Brian Armstrong, Fred Ehrsam, and Ben Reeves, however, Ben Reeves later parted, as he had his differences with Armstrong about how the Coinbase wallet should operate.

The current CEO is Brian Armstrong, with the President being Emilie Choi.

The exchange’s headquarters is located in San Francisco, California.

Security

You can add two-factor authentication to protect your account — which we highly suggest.

Coinbase has the second-highest insurance out of every cryptocurrency exchange at $255 million, only topped by Bittrex, which holds the record at $300 million.

In case the exchange gets hacked, even if the insurance is able to cover it, legal action can take years.

We strongly recommend everyone to use a hardware wallet.

Main Focus

In the past years, Coinbase has started to focus on listing high-quality altcoins, as well as making their portal more institutional friendly, with corporate accounts, vaults, and more Coinbase Pro features.

Frequently Asked Questions

Pros and Cons

Pros

- Wide variety of cryptocurrencies

- Great mobile app

- Extremely user-friendly

- Insured

- Supports almost all local currencies

- Possibly the most “legit” exchange out there

- Supports bank transfers

Cons

- Have to verify yourself before using the exchange

- Higher than average fees

Fees

Coinbase has a pretty complicated fee structure; they charge a spread of about 0.5%.

In addition, they also charge a Coinbase Fee:

- If the total transaction amount is less than or equal to $10, the fee is $0.99 | €0,99 | £0,99

- If the total transaction amount is more than $10 but less than or equal to $25, the fee is $1.49 | €1,49 | £1,49

- If the total transaction amount is more than $25 but less than or equal to $50, the fee is $1.99 | €1,99 | £1,99

- If the total transaction amount is more than $50 but less than or equal to $200, the fee is $2.99 | €2,99 | £2,99

Plus, there is a different credit/debit card buy rate for individual regions — but bank transfers always cost less than direct card purchases, so choose that option instead if you don’t need your cryptocurrencies urgently.

You can see the final fee amount when you place your order.

Use one of the links in this review to receive $10 worth of Bitcoin when you spend your first $100 on Coinbase.

Review Summary

9.4/10

Overall Score

Disclosure: The links in this review are referral links. Using them costs you nothing, but allows us to pay for hosting, and work on quality, fact-based reporting, which we are really thankful for.

We did not contact anyone before writing this review, and we rated them to our best knowledge.

![NullFUD – Financial Market [Fact Checks / News / Reviews] NullFUD](https://nullfud.com/wp-content/uploads/2019/07/272_90-nullfud-logo-with-text.png)